Empowering Parents Through Federal

Tax Credit Scholarships.

There is a new federal tax credit scholarship program that will expand K-12 educational opportunities to benefit millions of students throughout the nation for years to come.

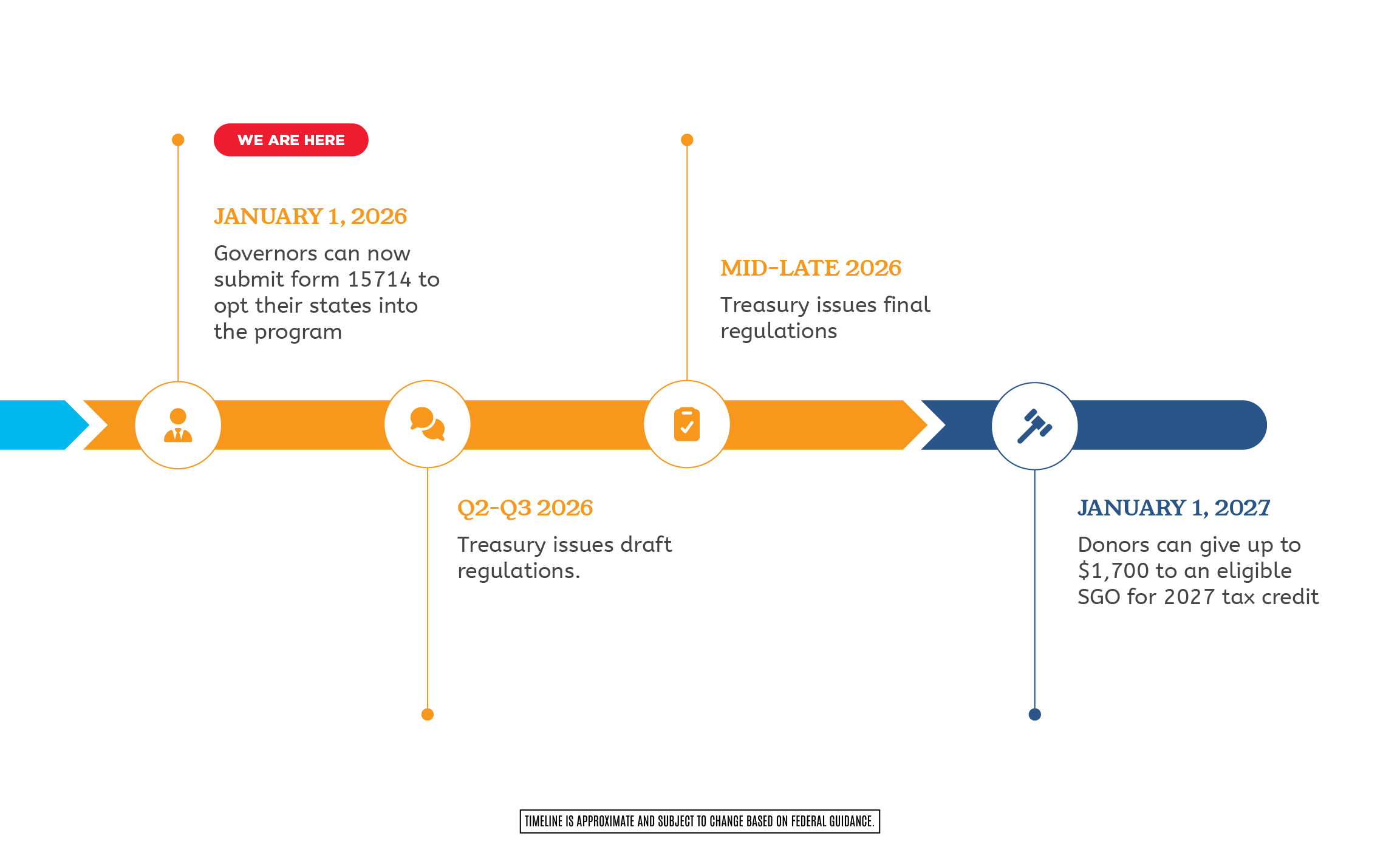

This program was signed into law in July 2025 and will take effect on January 1, 2027. These provisions are now permanently part of the U.S. tax code (section 25F of the Internal Revenue Code). This historic, first of its kind law provides a federal income tax credit for individuals who contribute to scholarship granting organizations (SGOs). These SGOs provide scholarships for eligible students in private and public elementary and secondary schools to access educational opportunities that best meet their needs.

Federal Tax Credit Scholarship Program Implementation Timeline

Key Provisions & Impact

State Opt-In Status

The federal tax credit scholarship law requires each state’s governor or designated officer or agency pursuant to state law to voluntarily elect whether this law takes effect in their respective state, informally known as the “opt-in” provision. The map below describes the opt-in status of each state.

Select a state to learn more about opportunities for students K-12.

Frequently Asked Questions

Get answers to common questions about school choice and our resources

General

For Parents

For Donors

For Tax Professionals

Updates

-

Invest in Education Foundation Announces Anne Lesser as New President and CEO

National school choice group elevates longtime leader to President and…

-

ICYMI: School Choice Champions Promote Historic Federal Tax Credit Scholarship Program

National School Choice Organizations highlight new federal tax credit scholarship…

-

New Federal Tax Credit Scholarship Program Would Provide New York Parents with Scholarship Funds for K-12 Education Options

His Eminence Timothy Cardinal Dolan, Archbishop of New York, joined Invest…

Our Mission

Invest in Education Foundation believes that financial limitations should not stand in the way of a high quality education for children in K-12 education.

Join our efforts for educational freedom

Be part of the movement to expand educational opportunities for all families. Stay informed and get involved in your community.